Divicast Movies: Your Online Cinema For Free And Some Alternatives

If you are a movie lover, then this article is going to be very informative for you. Today we are going to unwrap about divicast movies how they work and what is the purpose. Moreover, if you are a streaming lover this article is going to be very fruitful for you as well.

Divicast Movies is a movie website that allows its viewers a bunch of movies, TV shows, and music. As you know it is very difficult to watch movies online with good results. We can take the example of YouTube. When we search for any movie on YouTube, a lot of suggestions and related content would come but when we click on any movie after getting impressed from the thumbnails.

So, we came to know it is something really different from our search. And from what we wanted to see. Even the latest movies and TV shows do not come to YouTube before 1 or 2 years after the release date.

But in divicast movies, you will watch exactly what you searched for. Divicast offers you the latest movies and TV shows that no other sites offer.

Table of Contents

Divicast movies features and intro:

Regarding in the domain of Divicast, it has been approved to be one of the best movie-watching websites for all people. Solarmovie is also one of them and gives all services like Divicast but it depends on the user which platform they like to use. Entertainment is an indispensable part of life. We humans get bored with our daily routine and always want to watch movies or entertainment with our friends and family.

Here the interesting thing is unlike all other movie websites and apps divicast movies are free of cost. Mostly people in society do not like to pay to watch entertainment. They say it must be free.

Divicast came up with the best solution in this matter. That is the reason all the users are really satisfied with its services and entertainment offers.

Another interesting thing that you would like the most is a feature in Divicast that allows you to participate in different online bids and auctions in order to sell, purchase, advertise, and online participation.

In other words, you can do marketing of your brands and things through its ads services. Divicast movies website has traffic from all across the globe that you can use to do marketing of your brands and services as well.

As we have mentioned above that divicast is also one of the most appreciated sites for online streaming. Regarding the realm of streaming, it allows users to stream any type of movie and TV show they want. And this is not just for the old movies but for all the latest, trending, and top-rated, most-watched movies.

Recapitulating about the search box of divicast website. Its algorithm is very user-friendly and simple. If you don’t know the movie’s name you can also search for it by typing a simple title or any tagline. In this way, it would be very easy for you to watch any movie without wasting time for search.

The good news for the users is all the top movie studios have uploaded their movies, dramas, and TV series on divicast movies website.

Here We Have Top 52 Voodoo Movies of All Time Review Is divicast movies a paid website?

No, divicast is totally free. This question would be hitting your mind that with all the above-mentioned services it seems like this site would be charging some fee. But it is a piece of great news for all of you divicast is a totally free website for the latest movies, TV series, and online streaming.

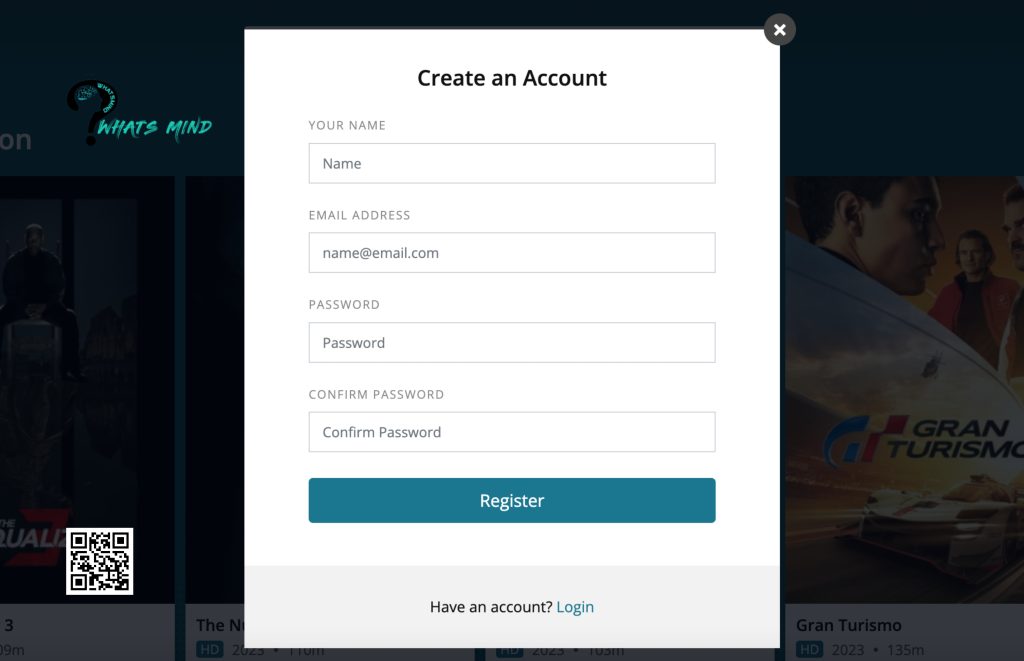

Step-by-step guide on how to login on Divicast website:

When you open the site, will come to know it is very simple to get registered on divicast site. Here is the method mentioned below.

- Go to the website Divicast.com

- There you’d see a login option on the top right side of your screen.

- Click on the person sign along with the login option.

- If you are a new member the option “Register” will be seen at the bottom of this section.

- Click on register.

- Give your name, email, and password.

- Welcome! You are registered for divicast movies now.

- Start watching your favorite movies free of cost with good results.

If You Are An Entrepreneur Then You Must Watch Movies like wolf of wall streetSome alternatives of divicast movies:

Here we also have brought up some alternatives of divicast for our readers.

- PrimeWire

- Soap2dayhd.co

- Hdtoday. tv

- Solarmovies

- M4uhd.tv

- 123Movies

Furthermore, you can also download movies through SkymoviesHD. It’s an online movie site where you can also download movies to watch offline when free.

Make some popcorn and start watching your favorite movie with your cinema partner.

Don’t forget to tell us which movie you watched and how was your experience with divicast movies after reading this article in the comment section below.

For more info visit Whatsmind.com